quitclaim deed colorado taxes

It doesnt take effect until after. Capital Contribution If property is being transferred to a business the consideration received in exchange for the interest is often capital in the company.

Quit Claim Deed Fill Online Printable Fillable Blank Pdffiller

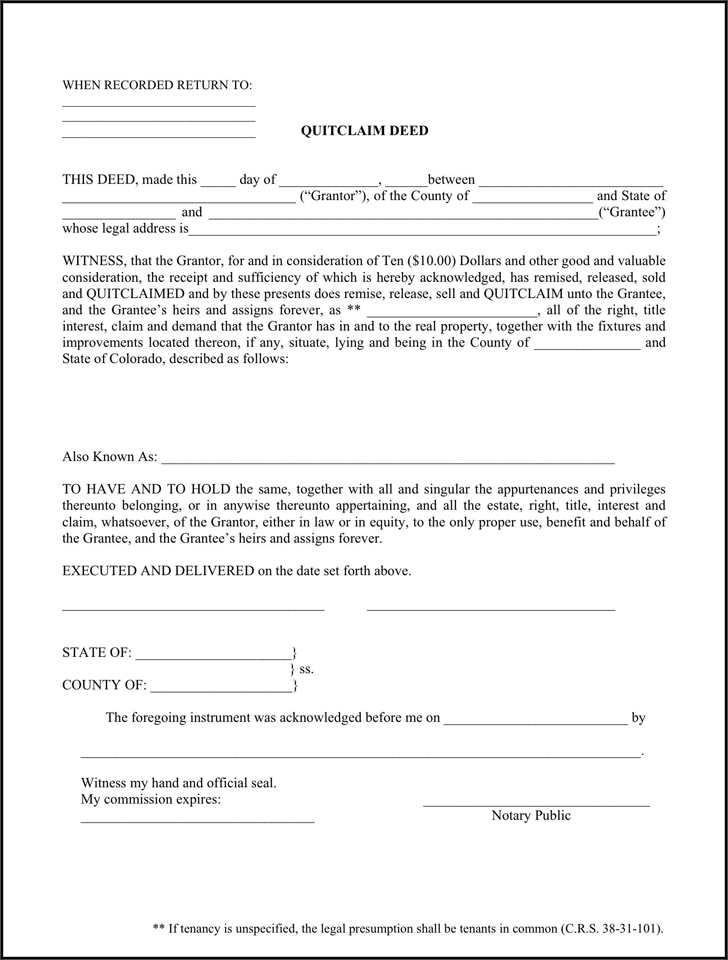

What if the Deed Does Not Specify the Form of Co-Ownership.

. If the transferor of a quitclaim deed in a home sale lived in the home as a primary residence at least two years of the past five capital gains of up to 250000 500000 if the quitclaim is conveyed by a couple filing jointly are excludable from tax. Then the person named in this deed could sell the property without waiting for the probate process. A quitclaim deed in comparison makes no promises about the grantors having clear title.

But Investopedia reminds that quitclaims. In most states a deed to multiple owners other than spouses that does not specify how the owners will hold title is presumed to be held with no right of survivorship under a form of co-ownership called tenancy in commonIf property is held as tenancy in common each owners interest passes to his or her probate. This deed must be signed and recorded with the court while the signer is living and it only becomes effective when the owner dies.

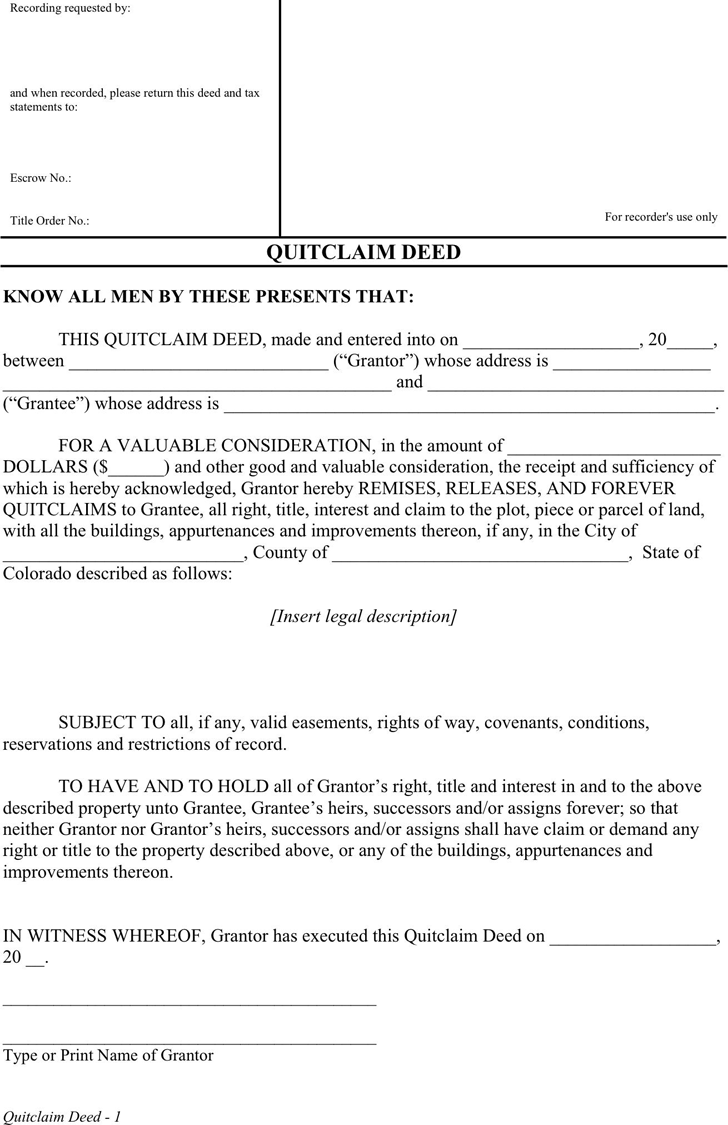

When to Use a Quitclaim Deed. A quitclaim deed is a document that is used to transfer ownership of real estate from one party to another. Quitclaim deeds are also sometimes called quit claim deeds or quick claim deeds because they are a fast way to accomplish real.

The excluded amount is taken off the taxpayers total allowable lifetime exclusion. A quitclaim deed transfers a prior co-owners portion of rights in a property to the other co-owner thereby making the grantee sole owner of the property. This document transfers ownership of your property just like a regular deed you might use to transfer real estate but with a crucial difference.

A quitclaim deed transfer only transfers the ownership rights the grantor haswith no guarantees. In states with documentary transfer taxes based on the amount of consideration including Florida and California specifying that the property was a gift can save transfer taxes. If you own real estate in Colorado and want to make sure it passes to your heirs without the hassle of probate court you can use a transfer-on-death TOD deed.

If the owner dies then the title transfers to the person named in this deed. A quitclaim deed is not generally used in a traditional sale of real estate.

Quitclaim Deed Colorado Fill Out And Sign Printable Pdf Template Signnow

Colorado Quitclaim Deed Legal Form Nolo

Free Colorado Quitclaim Deed Form Pdf 8kb 1 Page S

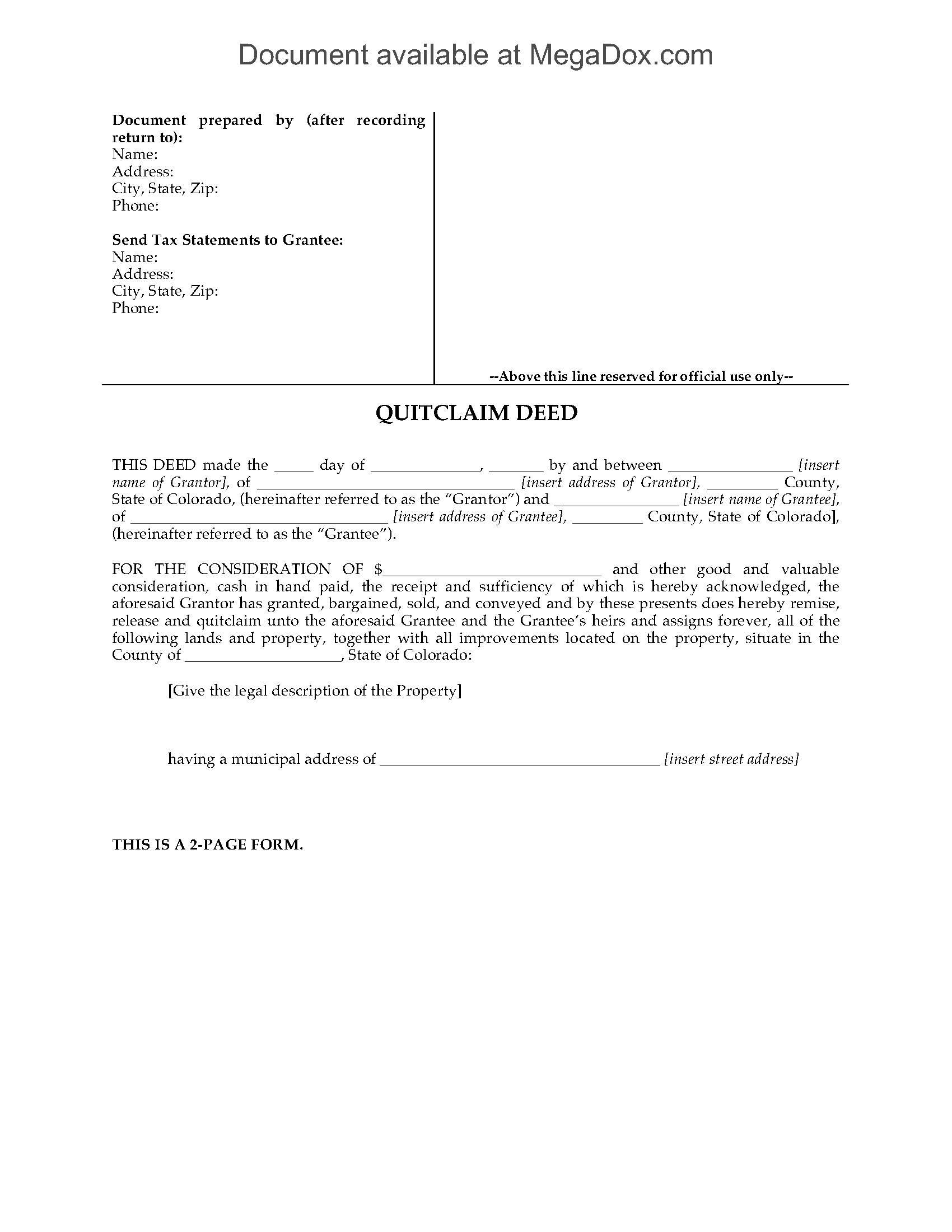

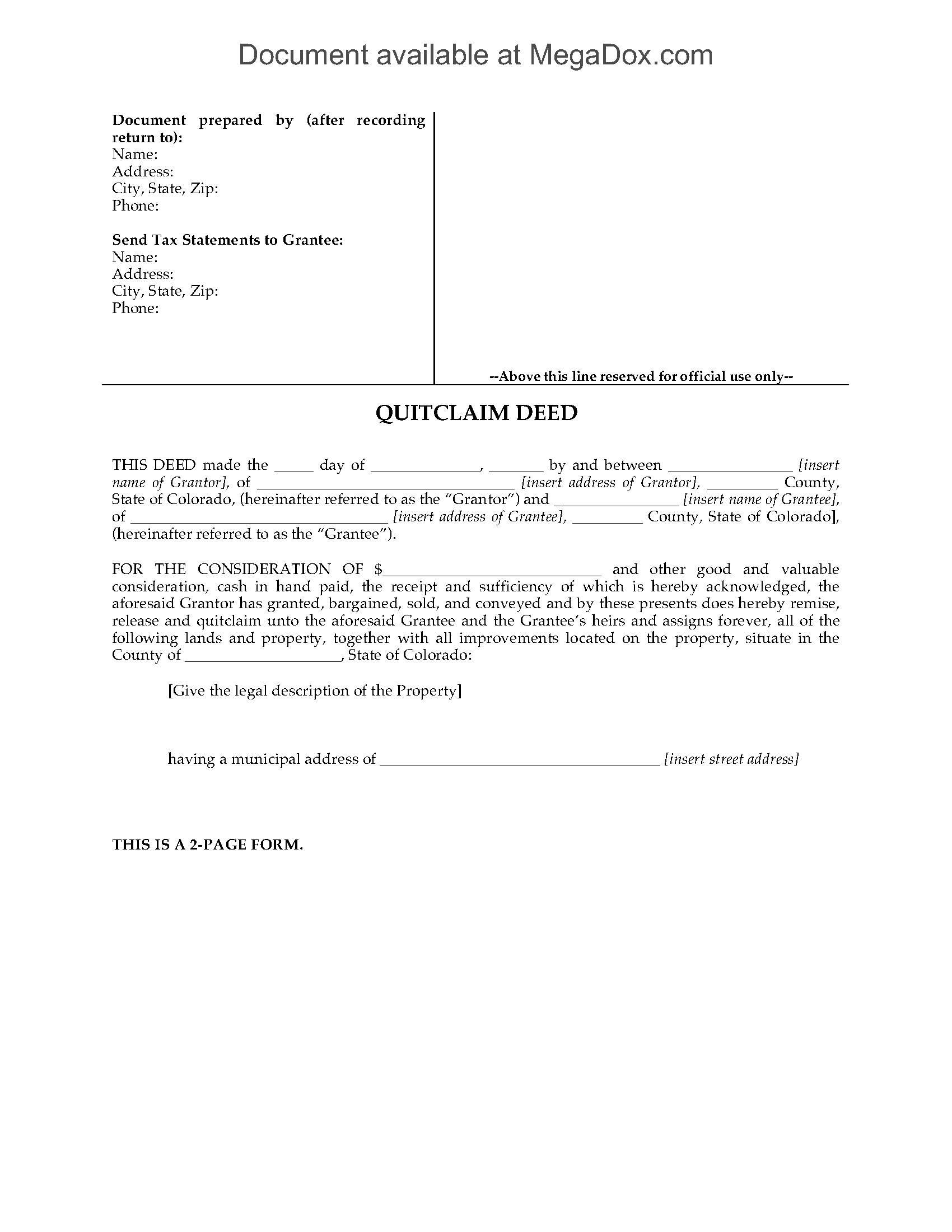

Colorado Quitclaim Deed Legal Forms And Business Templates Megadox Com

Is A Quitclaim Deed Subject To Tax Deeds Com

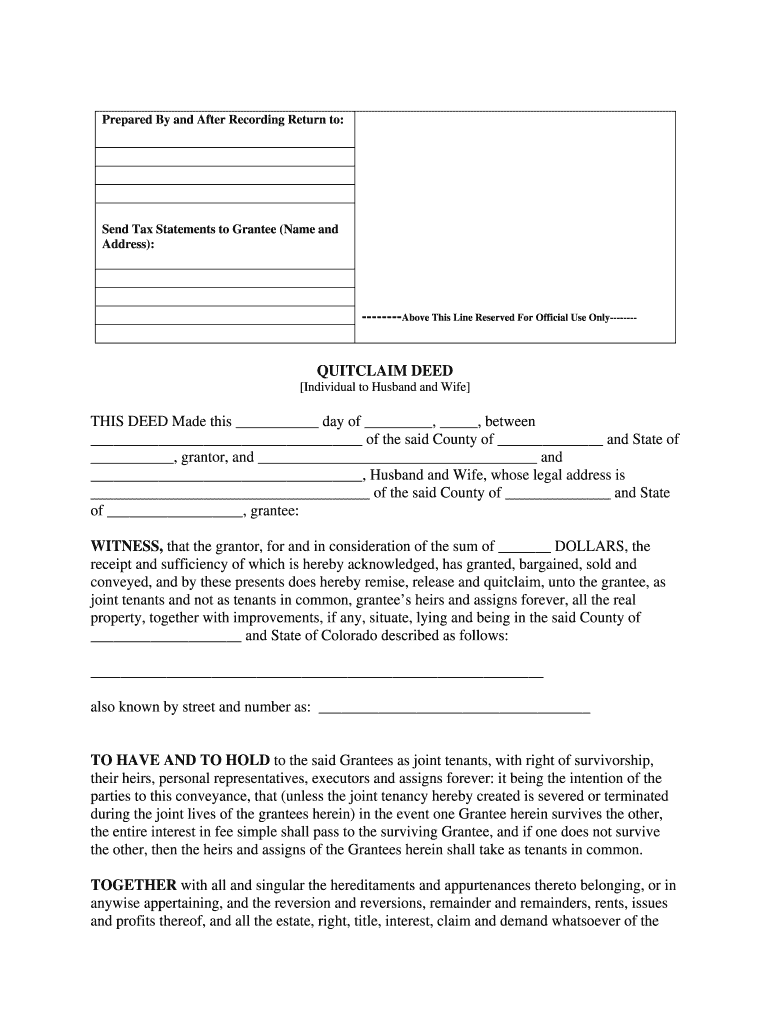

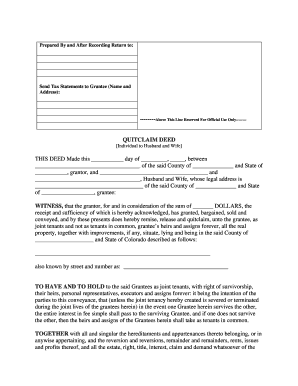

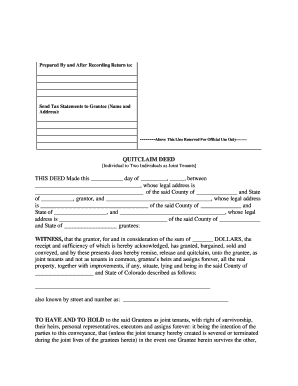

Colorado Quit Claim Deed Joint Tenancy With Right Of Survivorship Fill Online Printable Fillable Blank Pdffiller

Colorado Quit Claim Deed Joint Tenancy With Right Of Survivorship Fill Online Printable Fillable Blank Pdffiller

Free 10 Sample Quitclaim Deed Forms In Pdf Ms Word

Free Quit Claim Deed Form Printable Pdf Template

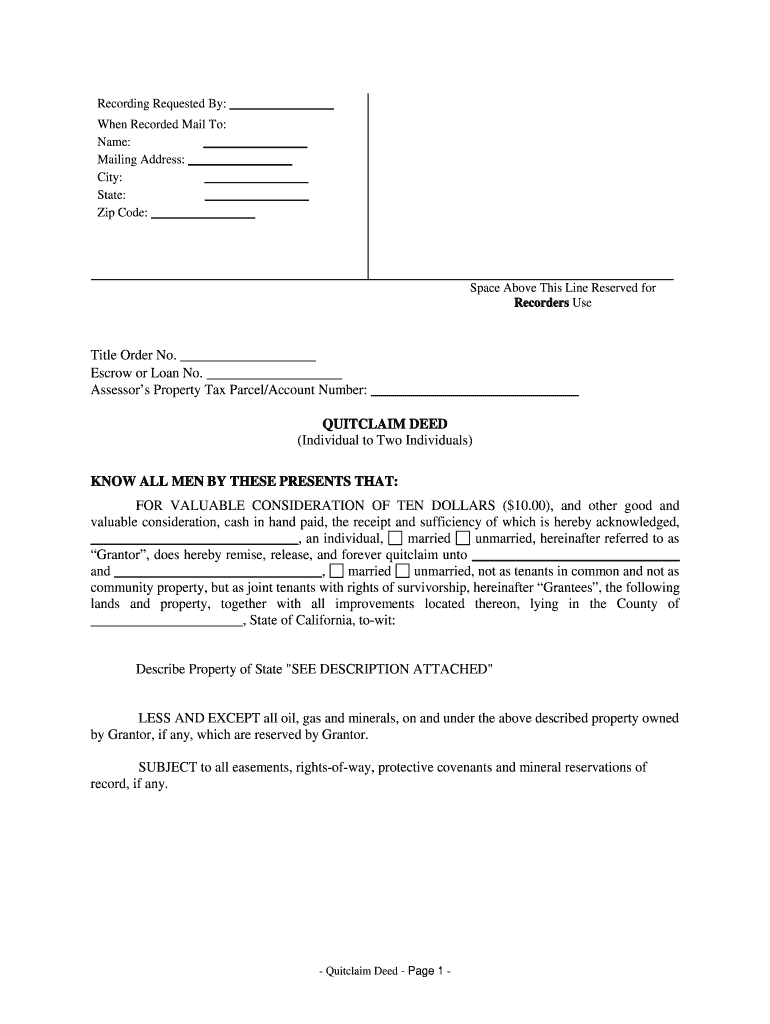

California Quitclaim Deed Ezlandlordforms

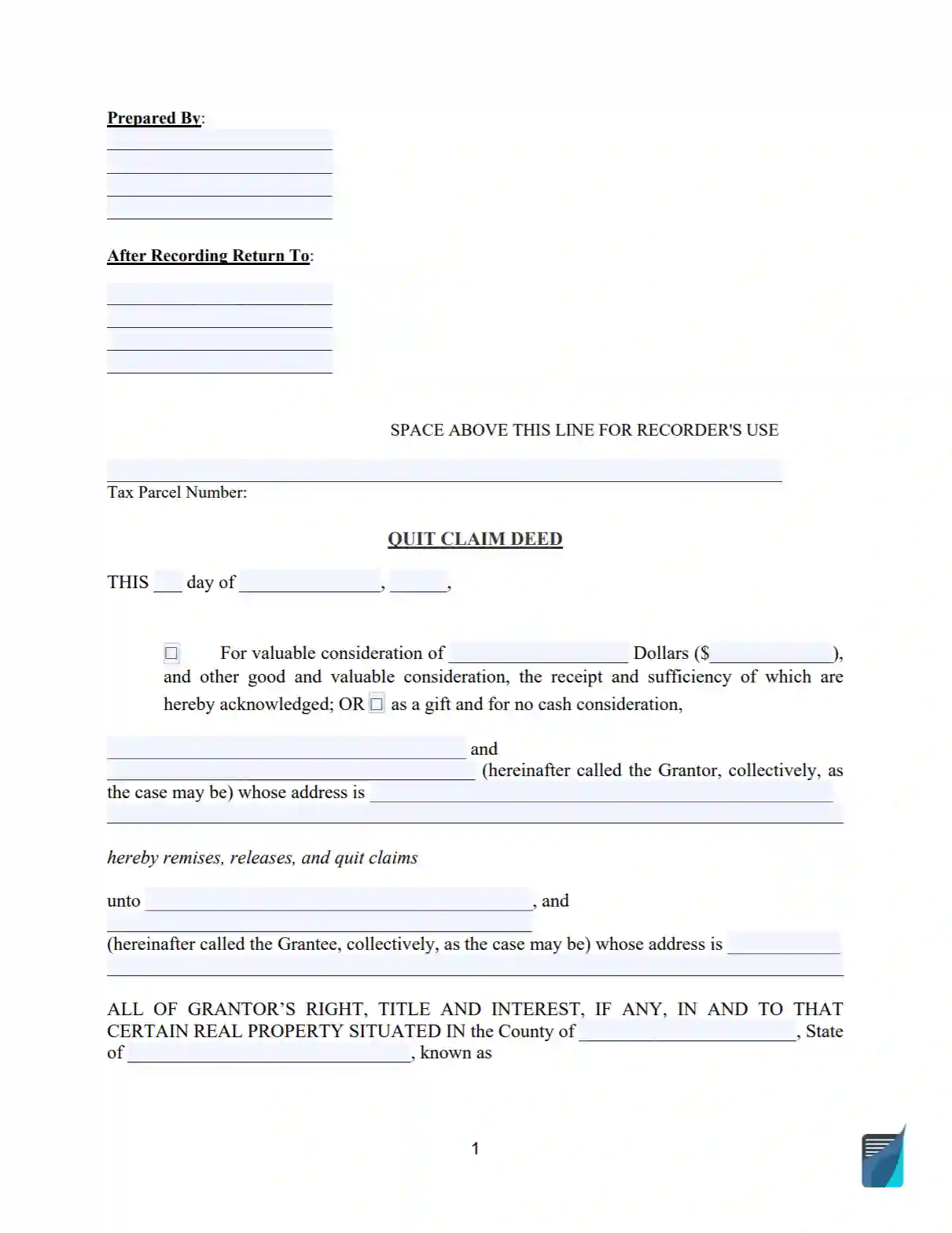

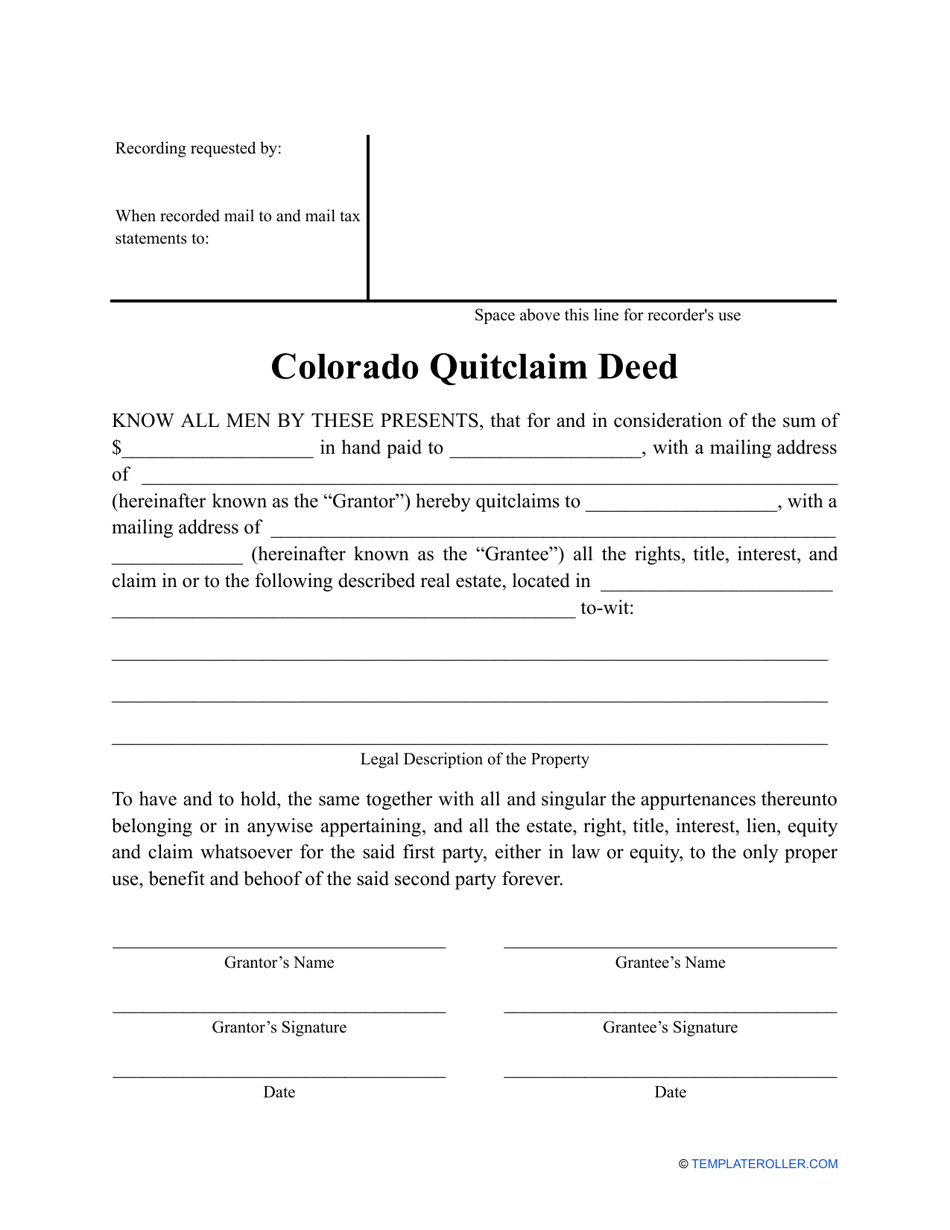

Colorado Quitclaim Deed Form Download Printable Pdf Templateroller

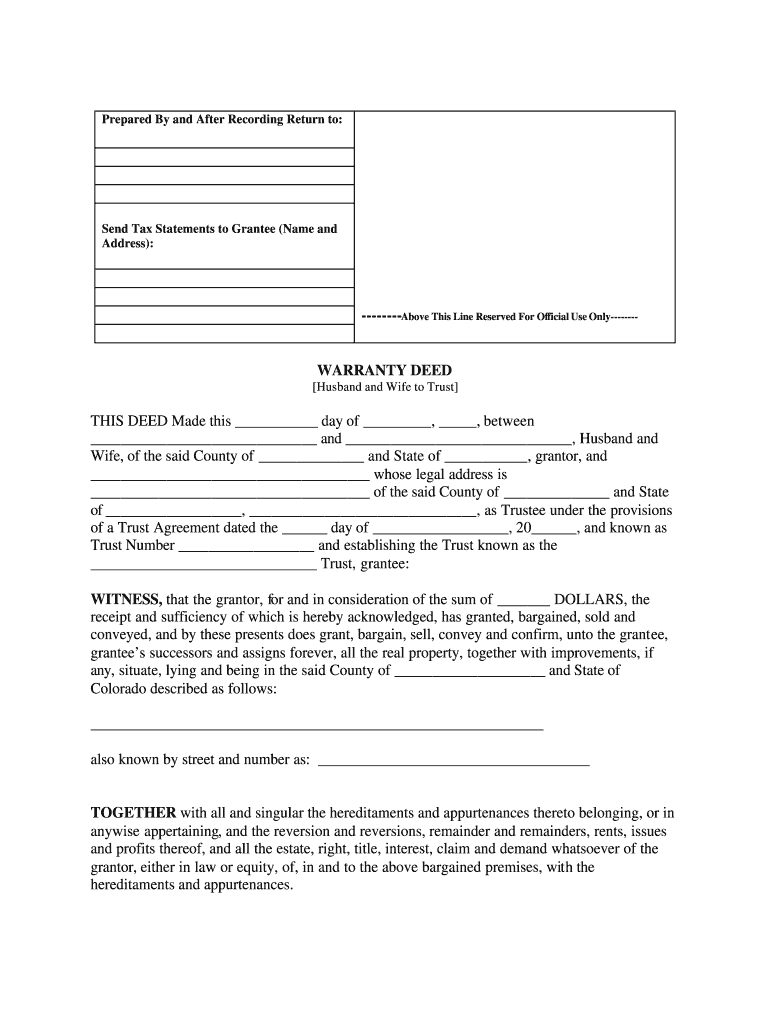

Co Warranty Deed Complete Legal Document Online Us Legal Forms

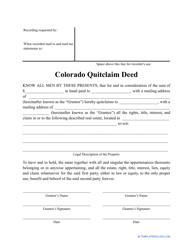

Free Colorado Quitclaim Deed Form How To Write Guide

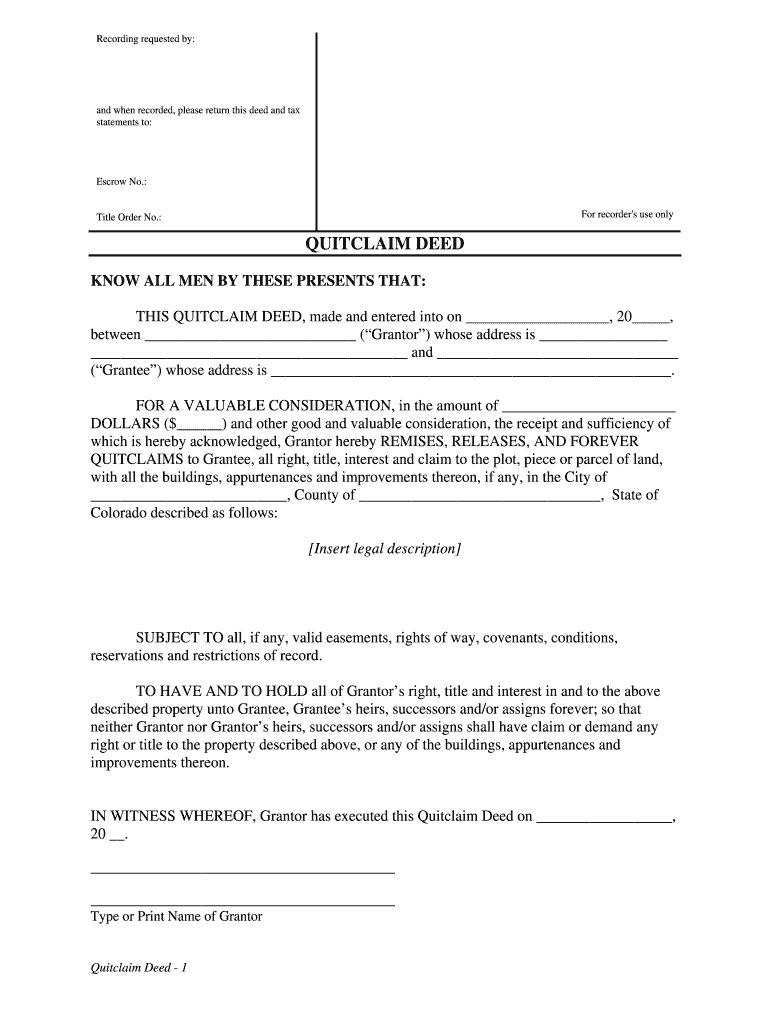

Colorado Quit Claim Deed Fill Online Printable Fillable Blank Pdffiller

Colorado Quitclaim Deed Form 2 Pdfsimpli

Joint Tenancy Quit Claim Deed Form Fill Online Printable Fillable Blank Pdffiller

Colorado Quitclaim Deed Form Download Printable Pdf Templateroller

Free Colorado Quitclaim Deed Form Pdf 38kb 4 Page S

Colorado Quitclaim Deed For Joint Ownership Legal Forms And Business Templates Megadox Com